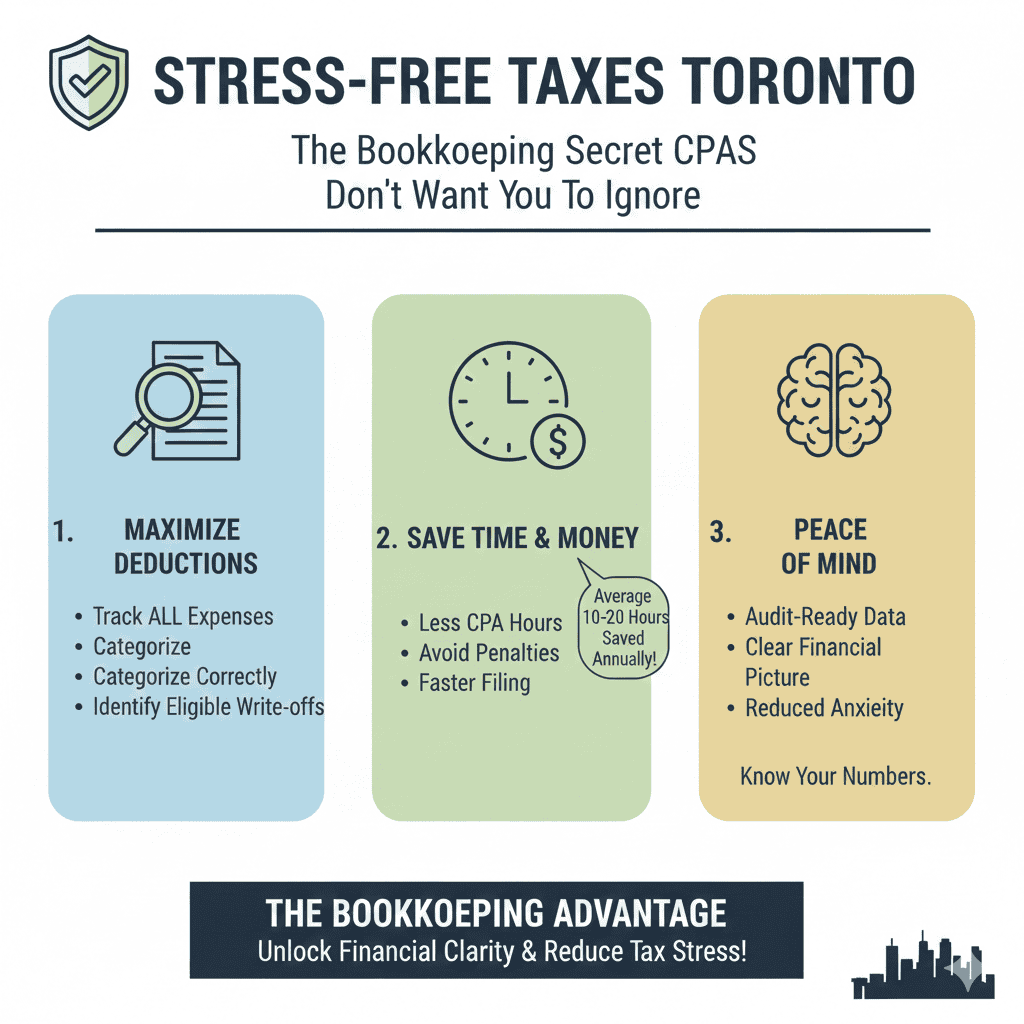

Why Organized Bookkeeping Is the Key to Stress-Free Tax Filing for Toronto Businesses

Running a business in Toronto is both rewarding and challenging. Between managing staff, serving clients, tracking expenses, and planning for growth, financial responsibilities can quickly become overwhelming. Among these responsibilities, tax filing is often the most stressful, particularly for small and medium-sized businesses. Yet, the key to stress-free tax filing is often surprisingly simple: organized bookkeeping.

Bookkeeping isn’t just a mundane administrative task. It forms the backbone of a business’s financial health. Accurate and systematic record-keeping ensures that every dollar is accounted for, expenses are tracked correctly, and income is reported accurately. For businesses in Toronto, maintaining clean financial records can make the difference between a smooth tax season and a stressful, error-filled experience.

The Challenges Toronto Businesses Face During Tax Season

Many Toronto business owners approach tax filing as a once-a-year task, scrambling to gather receipts, invoices, and statements at the last minute. This reactive approach creates multiple challenges:

- Missing or inaccurate records can lead to penalties from the Canada Revenue Agency (CRA).

- Businesses may overlook eligible deductions, resulting in higher tax liabilities.

- Reconciling accounts at the last minute can be time-consuming and error prone.

- Stress and uncertainty can divert attention from core business operations.

Without proper bookkeeping throughout the year, tax filing becomes a reactive and often overwhelming process. It can also leave business owners vulnerable to audits or compliance issues.

How Organized Bookkeeping Supports Accurate Tax Filing

Organized bookkeeping provides clarity and control over a company’s finances. When records are kept consistently, it’s easier to prepare for tax season, track cash flow, and plan for upcoming obligations. Some key benefits include:

1. Easy Access to Financial Records

When bookkeeping is organized, all receipts, invoices, and statements are stored systematically. This makes it simple to locate information during tax preparation or in case of an audit. Businesses no longer waste hours digging through piles of paperwork or unorganized digital files.

2. Accurate Tracking of Income and Expenses

Bookkeeping ensures that every transaction is recorded correctly. Businesses can quickly identify what qualifies as a deductible expense, helping reduce taxable income legally and efficiently. Accurate records also prevent errors that could trigger audits or fines.

3. Timely Preparation for Tax Filing

Consistent bookkeeping allows business owners to prepare tax returns in advance. Instead of rushing at the end of the year, companies can plan ahead, reconcile accounts, and ensure all necessary documentation is complete. This proactive approach reduces stress and minimizes the risk of late filing penalties.

Professional Support from a Business Tax Accountant in Toronto

Even with organized bookkeeping, professional expertise can make a significant difference. A business tax accountant in Toronto not only ensures compliance with CRA regulations but also provides strategic guidance to minimize tax liability. They review financial records, identify potential deductions, and make sure that tax return filing is accurate and timely.

Working with an accountant allows business owners to focus on running their operations rather than worrying about complex tax rules. Their knowledge of local tax laws and industry-specific considerations ensures that businesses don’t miss opportunities to save or stay compliant.

Common Bookkeeping Mistakes That Complicate Tax Filing

Many Toronto businesses unknowingly make bookkeeping errors that create challenges during tax season. Some of the most common mistakes include:

Many Toronto businesses unknowingly make bookkeeping errors that create challenges during tax season. Some of the most common mistakes include:

- Mixing personal and business expenses

- Failing to record all transactions consistently

- Ignoring petty cash or small purchases

- Delaying entry of invoices and receipts

- Not reconciling bank statements regularly

Each of these mistakes can result in inaccurate tax filings, missed deductions, and unnecessary stress. By adopting best practices in bookkeeping, businesses can avoid these pitfalls and simplify tax preparation.

Practical Steps to Maintain Organized Bookkeeping

Implementing organized bookkeeping doesn’t have to be complicated. Here are some practical steps businesses can take:

- Use accounting software to record all transactions digitally

- Categorize income and expenses clearly for easy tracking

- Keep all receipts and invoices in a consistent format

- Reconcile bank accounts monthly

- Review financial reports regularly to ensure accuracy

- Retain documents for the required CRA period

Additionally, businesses can benefit from professional bookkeeping services, which transform bookkeeping from a tedious task into a strategic advantage. These services provide insights that help optimize finances, reduce errors, and ensure smoother tax filing each year.

How Bookkeeping Impacts Business Growth

Bookkeeping isn’t just about tax compliance—it’s also a tool for strategic decision-making. Accurate financial records give business owners insights into profitability, cash flow trends, and spending patterns. This information can inform budgeting, pricing decisions, and investment planning.

Companies that maintain organized bookkeeping are better equipped to apply for loans, secure investors, or expand operations because their financial position is clearly documented and transparent. Tax season becomes a reflection of well-managed finances rather than a stressful scramble.

Why Stress-Free Tax Filing Matters

Tax season is one of the most stressful periods for business owners. Poorly managed records can lead to:

- Errors in tax returns

- Missed deductions

- Penalties or interest from late filings

- Increased audit risk

By maintaining organized bookkeeping and working with a professional accountant, businesses minimize these risks. Stress-free tax filing not only saves time and money but also allows business owners to focus on growth and operations rather than worrying about compliance.

How Gondaliya CPA Supports Toronto Businesses

For Toronto businesses seeking peace of mind during tax season, Gondaliya CPA offers comprehensive support. The firm provides guidance on maintaining organized financial records, ensures accurate tax filing in Toronto, and offers advice to optimize deductions and compliance. Their professional bookkeeping services help businesses stay structured year-round, transforming record-keeping from a chore into a strategic tool.

By combining year-round bookkeeping best practices with expert advice from a business tax accountant, companies can streamline operations, reduce stress, and make better financial decisions throughout the year.